PGE Increases Capital Expenditure, Focuses on Offshore Wind and Gas Projects

In the first six months of 2024, PGE Polska Grupa Energetyczna increased its capital expenditure to PLN 4.64 billion, up from PLN 3.95 billion in the same period last year. This rise comes as PGE adapts to dynamic energy market changes and new regulations, according to CEO Dariusz Marzec. Key investments for the second half of the year include securing financing for the large-scale offshore wind farm Baltica 2 and finalizing gas projects.

PGE generated a net profit of PLN 2.09 billion, slightly down from PLN 2.17 billion in 2023, while recurring EBITDA in Q2 reached PLN 2.3 billion. The conventional energy segment continued to struggle, with an EBITDA loss of PLN 177 million, driven by lower electricity margins. However, the renewable energy segment saw an increase to PLN 267 million due to reduced energy purchase costs and capacity market revenues.

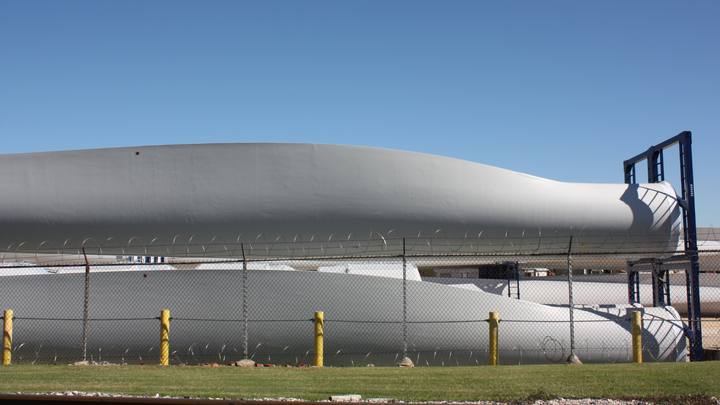

The Baltica offshore wind farm, developed in partnership with Ørsted, is expected to reach a capacity of 2.5 GW by 2030, with additional projects to follow, totaling over 7 GW by 2040. PGE is also advancing gas projects, including gas blocks in Gryfino and Wrocław’s EC Czechnica, set to significantly reduce CO2 emissions by 622,000 tons annually.

Marzec highlighted the importance of these projects in strengthening PGE’s transition to low-emission energy sources.

Source: Gramwzielone